Description of the industry and competitive analysis. Rostelecom is a huge aircraft carrier Customer reviews about the Rostelecom provider

Main article about the company: Rostelecom

2019

Growth in revenue by 5%, net profit - by 10%

In February 2020, Rostelecom presented its audited financial results. The company's revenue in 2019 reached 337.42 billion rubles, an increase of 5% compared to the previous year.

Growth was largely facilitated by the provision of digital services, note in Rostelecom. Annual income from services broadband access(broadband access) to the Internet increased to 83.87 billion rubles from 80.04 billion rubles a year earlier. Television services brought Rostelecom 37.13 billion rubles, surpassing the result of a year ago of 34.46 billion rubles.

In the fixed telephony market in 2019, the operator earned 61.74 billion rubles. In 2018, revenue was higher and amounted to 69.99 billion rubles. The company earned 49.8 billion rubles from cloud and VAS services, while in 2018 these revenues were 36.9 billion rubles.

The number of the operator's subscribers increased in almost all sectors. The growth in the number of Internet users amounted to 2% (13.2 million by the end of 2019), pay TV users - by 3% (of which the number of Interactive TV subscribers increased by 6% to 5.6 million), virtual operator subscribers - 41% (up to 1.7 million). At the same time, the number of local telephone subscribers continues to decline: it fell by 10% and amounted to 15.7 million by the end of 2019.

The average revenue from one subscriber of broadband Internet services reached 402 rubles, an increase of 2%. In the pay TV segment, there was an increase of 2% to 255 rubles.

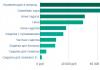

Among the areas that showed the greatest growth are information security (growth - 68%), data center services (50%), smart city projects (50%). IN in absolute terms revenue from them made 3.7 billion, 10.8 billion and 34 billion rubles, told TAdviser in Rostelecom. The president of the company Mikhail Oseevsky in a conversation with TAdviser noted that especially good results in cybersecurity business were shown by the direction of solutions DLP which are used by a number of large customers, including Sberbank, the Russian Railway and Rosneft.

Rostelecom ended 2019 with a net profit of 16.47 billion rubles, which is 10% higher than a year ago. Net profit amounted to 4.9% of revenue against 4.7% in 2018.

| Good results 2019 became possible thanks to the efforts of all blocks of client segments on the path of digital transformation and the promotion of modern digital services. At the same time, the segment of corporate and government clients, on whose sustainable development we stake, showed the best double-digit growth - 13% year-on-year, - said Vladimir Kiriyenko, First Vice President of Rostelecom. |

Earlier, at the end of February, Tadviser wrote about preliminary, unaudited financial results, which Mikhail Oseevsky represented at a meeting of the Federation Council. They did not differ much from the audited ones: the announced revenue was more than 335 billion rubles, the profit was about 16 billion rubles. The company's OIBDA reached about 106 billion rubles, an increase of about 5% over the year.

Mikhail Oseevsky spoke at the 475th meeting of the Federation Council on February 26 (photo - Federation Council)

The volume of the investment program of Rostelecom in 2019 amounted to 100 billion rubles, of which 70 billion are the company's own funds and 30 billion are funds federal budget, cited Oseevsky's data.

The President of Rostelecom at a meeting of the Federation Council recalled that the company had recently acquired Tele2. With this in mind, Rostelecom at the end of 2020 will be the largest digital company in Russia with revenues of more than 500 billion rubles, Oseevsky said.

Speaking to the senators, Oseevsky noted that the company is rapidly transforming: from an operator, it is turning into a provider of digital services for individuals, businesses and the state. The main direction for Rostelecom now is the provision of services to citizens. First of all, it is broadband Internet access (BBA). The company invests a lot in this area, says Mikhail Oseevsky. According to his estimates, the company occupies 41% of the broadband access market.

And with the acquisition of Tele 2, the company will also be able to provide cellular services that will complement its range of services for citizens, Rostelecom expects.

Rostelecom also expands the range of services for citizens through smart home solutions and services. Every month, the company installs about 20,000 sets of such devices.

The second largest area is the provision of services to legal entities. In total, Rostelecom has more than 600,000 clients here, including the largest Russian companies, but, according to Oseevsky, a special priority is medium and small businesses, for which there are special solutions.

Next in terms of volume, in equal shares, are projects for the state and partners in the operator business. By preliminary estimates according to management reporting, interaction with telecom operators accounts for approximately 15% of Rostelecom's business.

Oseevsky stressed that one of the growth drivers for Rostelecom is participation in the Digital Economy national program. In three of its areas, the company plays an “exceptional role”: the area of information infrastructure, where the government has appointed Rostelecom as a center of competence, public administration and information security.

Among recent infrastructure projects, Mikhail Oseevsky cited the laying of submarine cables to Sakhalin, Kamchatka, Magadan, Kurile Islands, and now residents of these remote areas have the opportunity to use all the same products and services as other residents of the country. And in 2021, Rostelecom will start laying a cable to Chukotka.

Among other projects within the framework of the information infrastructure of the "Digital Economy" is the elimination of the digital divide, which involves providing Internet access to small settlements.

Data centers are an important area of digital infrastructure, the president of Rostelecom noted: this is the brain of the digital economy. Rostelecom is the largest operator of such services, Oseevsky says: more than 25% of all information in the country is stored in Rostelecom's data centers.

The company is implementing a large-scale program for the construction of data centers throughout the country, and in the near future plans to complete the construction of data centers in the capitals of federal districts, and then move on to their creation in the capitals of other subjects of the federation. Data today should be as close as possible to users, emphasized Oseevsky.

As for the direction of information security, Mikhail Oseevsky calls Rostelecom the largest operator providing commercial services government and business in providing information security. Among his clients are a number of federal departments and major Russian companies. In 2019, more than 1 million attacks against customers and Rostelecom's own infrastructure were repelled. Four IS centers were established for round-the-clock monitoring. This is the fastest growing direction of the company, said the president of Rostelecom.

Investments in the Russian OS "Aurora" depreciated by a third

On June 19, 2019 it became known of write-off by Rostelecom of one third of investments into the Russian mobile operating system "Aurora". Read more.

2018: Revenue growth up to 320 billion rubles

Cloud services and value-added services were among the other areas that showed the greatest growth: it grew by 42%. A significant share of this direction is made up of various data center services. Thus, revenue from Virtual Data Center/IaaS services increased by 40%.

The main priority of the company, as he specified, will be the development of access in areas of mass housing development. At the end of 2018, it is planned to complete the work on laying a submarine cable to Far East and connect the Kuril Islands to the Internet.

- Revenue grew by 3% to 305.3 billion rubles. compared to 12 months of 2016;

- OIBDA increased by RUB 0.085 billion. up to 96.9 billion rubles. compared to 12 months of 2016;

- OIBDA margin was 31.7% compared to 32.5% in 12M 2016;

- Net profit increased by 15% to RUB 14.05 billion. compared to 12 months of 2016;

- Capital investments amounted to 60.8 billion rubles. (19.9% of revenue), decreasing by 2% compared to the same period in 2016 (61.9 billion rubles and 20.8% of revenue for 12 months of 2016);

- FCF grew by 53% to RUB 20.4 billion. compared to 12 months of 2016, having improved by 7.1 billion rubles.

Credit rating AA(RU), outlook Stable

Kai-Uwe Mehlhorn, Senior Vice President and financial director: “We believe that the assignment of this rating opens up for the company additional features to raise public debt financing, including to optimize our debt portfolio.”

2016

In May 2017, the Board of Directors of Rostelecom approved the agenda of the annual general meeting of shareholders and made recommendations on dividends for 2016. At the meeting of shareholders, it was recommended to allocate for the payment of dividends on ordinary and preferred shares in total amount 15 billion rubles, which is 113% of free cash flow and 122% of the company's net profit.

Dividends are proposed to be paid on preferred shares of type A - in the amount of 5.39 rubles per share, on ordinary shares - in the amount of 5.39 rubles per share.

The Board of Directors also determined the dates for compiling the list of persons entitled to participate in the General Meeting of Shareholders and receive dividends - May 25 and July 7, 2017, respectively. The general meeting of shareholders of the company will be held on June 19.

"The level of dividends proposed by the board of directors for approval general meeting shareholders, corresponds to reality results companies in reporting period. This year, the company proposes to significantly increase the share of distributed free cash flow, thereby demonstrating its commitment to the implementation of the main principles of our dividend policy, namely, to send our shareholders more than 3/4 of free cash flow, but in any case not less than 45 billion rubles over 3 years, without increasing debt burden. We believe that the proposed level of 5.39 rubles per share allows maintaining a high dividend yield and is generally in line with the company's current policy," said Mikhail Oseevsky, President of Rostelecom.

Revenue 297 billion rubles

- Revenue increased by 91 million rubles. up to 297.4 billion rubles;

- OIBDA decreased by 4% to RUB 96.8 billion;

- OIBDA margin was 32.5% compared to 33.9%;

- Net profit decreased by 15% to RUB 12.2 billion;

- Capital investments amounted to 61.9 billion rubles. (20.8% of revenue) decreasing by 1% compared to the same period last year (62.7 billion rubles and 21.1% of revenue for 12 months of 2015);

- FCF amounted to 13.3 billion rubles. against 22.0 billion rubles.

- The share of the Digital segment in revenue was 44%;

- According to the results of 2016, the share of Rostelecom in new connections in the pay TV market was about 50% and in the broadband Internet market - more than 50%;

- Consistently high growth rates of broadband access subscriber base optical technologies(+17%) and IPTV (+24%);

- The B2B/G segment showed revenue growth of 2.5% yoy.

For 12 months of 2016, operating expenses net of depreciation increased by 2% compared to the same period in 2015 and amounted to RUB 202.0 billion. The dynamics were influenced by the following factors:

- a 5% increase (by RUB 2.3 billion) in expenses on services of telecom operators, including due to an increase in content costs caused by an increase in the number of pay TV subscribers;

- 11% decrease (by RUB 1.7 billion) in other operating income, mainly in terms of the project to bridge the digital divide; excluding reimbursement under the UCN project, the growth of other operating income amounted to 94%;

- a more than two-fold increase (by RUB 2.4 billion) in profit from the disposal of fixed assets, mainly due to the closing of a transaction to create a real estate sub-fund in the form of a joint venture with Sberbank;

- significant recovery of the allowance for doubtful debts in 2015;

- decrease by 1% (by RUB 0.7 billion) in personnel costs, mainly due to staff optimization.

2015: Decrease in revenue, profit growth

2014: Reducing net profit by 16% to 29.5 billion rubles

The net profit of the Russian operator Rostelecom for 2014 fell by 16.4%, from 35.3 billion to 29.5 billion rubles. This is evidenced by the reporting data under RAS (Russian standards accounting), RBC reported in March 2015.

In 2014, Rostelecom spent 46.1 billion rubles to pay off long-term liabilities, reducing their volume to 138.9 billion rubles. Instead, short-term liabilities increased by 29.7 billion rubles, to 53.7 billion rubles.

The company's revenue grew to 290.6 billion rubles, which is 2.3% higher than last year.

2013: Decrease in all main indicators

The company predicted that in 2013 net profit could reach 25 billion rubles, in 2014 - 40 billion rubles. The merger of Svyazinvest with Rostelecom will increase revenue by 1% in 2013 and 3% in 2014. Without the effect of the merger of Svyazinvest, Rostelecom forecasted revenue for 2013 in the amount of 327 billion rubles, OIBDA according to forecasts company in 2013 will amount to 120 billion rubles, and by 2016 it will increase to 150-160 billion rubles. By 2016, the company planned to increase revenue by 7%, up to 407 billion rubles.

When Rostelecom published its financial results for 2013 in March 2014, it turned out that the company's revenue did not meet the forecast and decreased by 2% to RUB 325.7 billion, OIBDA (operating income before interest on loans and depreciation expenses ) fell by 6% to 113 billion rubles. Operating profit decreased by 17% to 45 billion rubles. Net profit decreased even more - by 27% to 24 billion rubles.

For the 4th quarter of 2013, the company's net profit decreased by 62% compared to the same period in 2012, amounting to 1 billion rubles. The company explains this by one-time write-offs made due to the revaluation of the option to repurchase Rostelecom's 2.7% of its own shares from Deutsche Bank and RDIF, as well as the tax effect caused by the creation of provisions for doubtful debts of Sky Link (cellular subsidiary Rostelecom). Capital investments for the year decreased by 27% to 68.5 billion rubles.

Of the types of business, long-distance communications and channel leasing were the worst performing. Revenue from each of these two areas in 2013 decreased by 17% and amounted to 17.1 billion rubles. and 9.5 billion rubles. respectively. Revenues from zonal communications continue to fall: they decreased by 13% to 17 billion rubles.

By 5% - up to 38.9 billion rubles. - Decreased revenue from mobile communications. At the same time, the net loss from cellular communications in 2013 increased almost 7 times to 2.5 billion rubles. The operating loss from this area amounted to 366 million rubles. (a year earlier, operating profit amounted to 1.35 billion rubles). At this time, Rostelecom is in the process of transferring its cellular business to a joint venture with Tele2.

Most profitable business Rostelecom is left with local telephone communication - 87.5 billion rubles (decreased by 2%). The fastest growing segment is pay TV: growth was 29%, revenue reached 11.7 billion rubles.

Revenue from passing inter-operator traffic increased by 13% to RUB 24.5 billion, from broadband Internet access by 9% to RUB 56 billion. Cloud services grew by 10% to 23 billion rubles.

If we consider revenues by types of customers, then revenue from government customers decreased by 16% to RUB 45 billion, from corporate clients, on the contrary, increased by 4% to 74 billion rubles. Income from individuals and other telecom operators remained virtually unchanged, amounting to 165 billion rubles, respectively. and 40 billion rubles.

The number of fixed-line telephone subscribers of Rostelecom continues to fall: over the year it decreased by 6% to 26.5 million. The number of users of broadband Internet access, on the contrary, is growing: over the year it increased by 12% to 10.6 million. 62% are connected via xDSL technologies, 38% - via FTTB. The number of cellular subscribers increased by 9% to 14.8 million (growth was due to the Urals and Siberian regions).

The number of pay TV subscribers grew by 12% to 7.5 million, of which 71% are cable TV users, 29% are IPTV users.

2012: Growth of revenue for 7% to 321 billion rub

The Group's revenue for 2012 amounted to RUB 321.3 billion. and increased by 7% compared to 2011. The revenue structure changed in favor of growing segments, including, among other things, mobile communications, broadband access, pay TV. OIBDA margin was 36.9%, reflecting the effects of the active development of the mobile business in the regions where 3G+ networks are being built in Q4 2012, the increase in the share of fast-growing but less profitable than traditional revenue segments, the creation of employee compensation reserves within 20 % optimization administrative staff planned for 2013. Net profit for 2012 amounted to 35.2 billion rubles. Net debt as of December 31, 2012 amounted to RUB 203.1 billion. In 2012, the total debt of OJSC Rostelecom increased by 24%, amounting to 214.4 billion rubles.

2011

Results of the year: voice telephony - 58% of revenue

Rostelecom's revenue for 2011, determined in accordance with Russian standards accounting (RAS), amounted to 296 billion rubles. Net profit of Rostelecom in 2011 amounted to 46.1 billion rubles, consolidated revenue amounted to 296 billion rubles.

Revenue structure:

- voice telephony services - 58% of all company revenues - more than 124 billion rubles.

- data transmission services - 23% of revenue (more than 49 billion rubles).

- cellular communication services - 5.1% (about 10 billion rubles)

- provision of communication channels for use - 4.5% (approximately 9 billion rubles).

- services of television and radio broadcasting, satellite and radio communications - 1.5% (slightly more than 3 billion rubles).

Rostelecom's e-government revenue more than doubled in 2011, by 132%. In the structure of its revenue, this direction takes less than 1%.

Operating profitability is also growing - in 2010 it was around 5%. Rostelecom expects that the profitability of this area will be at the level of its other businesses, says the representative of the operator Kira Kiryukhina.

In terms of profitability, e-government is comparable to international and long distance communication, knows a source in the company. For projects of this type, 20% is the usual yield, says Sergey Matsotsky, CEO of the IBS system integrator. And for the founder of the Lanit system integrator, Georgy Gens, such profitability under a government contract for an IT project “seems like a fairy tale”: competition has now intensified and the margin has decreased as a result. Apparently, the operator part brings the main profit in this contract to Rostelecom, he suggests.

However, it is not clear how Rostelecom was able to allocate from its costs those that relate specifically to e-government contracts, an employee of another integrator is surprised and considers this figure to be “paper”.

9 months: Net profit growth by 2%

Net profit of Rostelecom under IFRS for 9 months of 2011 increased by 2% to 29.397 billion rubles. from 28.885 billion rubles. compared to the same period in 2010. Revenue increased by 7% to RUB 217.458 billion. from 203.287 billion rubles. OIBDA increased by 5% to RUB 85.517 billion. from RUB 81.525 billion, OIBDA margin was 39.3%.

First half of the year: growth of net profit by 6 times

According to the information and retrieval system DataCapital, Rostelecom's net profit under RAS in the first half of 2011 grew 6.23 times to RUB 13.939 billion. from 2.233 billion rubles. for the same period in 2010. Revenue increased 2.8 times to RUB 79.875 billion. from 28.467 billion rubles, profit from sales - by 4.91 times to 15.763 billion rubles. from 3.209 billion rubles.

2010

Ranking second in terms of revenue in the telecommunications industry at the end of the year

Unaudited consolidated revenue of the merged Rostelecom under IFRS in 2010 amounted to 275.7 billion rubles. ($9.05 billion at the exchange rate of the Central Bank on December 31, 2010).

Net profit - 40.8 billion rubles. ($1.34 billion).

This is the company's first report since, on April 1, 2011, it was joined by seven interregional communications companies (RTOs) and Dagsvyazinform, which were previously controlled by Svyazinvest. This reporting will become the basis for comparing the results that will be shown in 2011 by a single company, the representative of Rostelecom explained.

In terms of revenue for 2010, the merged Rostelecom outstripped Megafon, which in 2010 earned 215.5 billion rubles. And if we take into account only Russian operations, then Rostelecom was ahead of VimpelCom, losing only to MTS, whose Russian revenue amounted to 286.4 billion rubles. Nevertheless, the combined company's OIBDA margin turned out to be worse than that of the Big Three operators - 40.2%. For Russian operations of MTS, this figure was 43.4%, for MegaFon - 45.4%, and for VimpelCom - 46.2%. Compared to the Big Three operators, the share mobile business Rostelecom's is small, and the fixed business margin is much lower, explains Evgeny Golosnoy, an analyst at Troika Dialog. For a company that mainly deals with fixed-line communications, 40.2% is a good indicator of profitability, he said. Moreover, the tariffs for part of Rostelecom's services are regulated by the state, reminds Golosnoy.

In 2010, the merged Rostelecom received 32 billion rubles from the mobile business. revenue, which is only 11.6% of the company's total revenue. The Big Three operators, on the other hand, are still most revenues are earned on mobile communications: for MTS in Russia, this share is 82.7%, for VimpelCom - 83.6%, and for MegaFon - 96.5%.

Financial indicators for the third quarter

Revenue amounted to 15.8 billion rubles, including income from new and additional services, up 16% to 5.8 billion rubles (37% of revenue compared to 32% in the third quarter of 2009);

Adjusted OIBDA (net of accrual of non-cash expenses under the long-term incentive program for employees in the amount of RUB 461 million) amounted to RUB 3.2 billion; OIBDA margin 20.3%;

Net profit, adjusted for non-cash accrual of expenses under the long-term incentive program for employees, amounted to 1.4 billion rubles.

Capital investments amounted to 2.8 billion rubles. (17.5% of revenue)

Main financial indicators for the nine months of 2010:

Revenue amounted to 45.8 billion rubles, including income from new and additional services, which increased by 10% to 16.5 billion rubles (36% of revenue compared to 31% in the nine months of 2009);

Adjusted OIBDA (net of accrual of non-cash expenses under the long-term incentive program for employees in the amount of RUB 461 million) amounted to RUB 9.0 billion; OIBDA margin increased to 19.7%;

Net profit, adjusted for the accrual of non-cash expenses under the long-term incentive program for employees, amounted to 3.3 billion rubles.

Capital investments amounted to 7.7 billion rubles. (16.9% of revenue)

The capitalization of the company as of November 2010 is 120.5 billion rubles.

Q1: Sharp drop in revenue

In the first quarter of 2010, Rostelecom's RAS revenue fell by 8.2% compared to January-March 2009 to RUB 14.1 billion, the operator said. This is the largest drop in at least five years, says Veles Capital analyst Ilya Fedotov. The reason is a decrease in income from its traditional long-distance communication (in 2009 it provided 71.4% of Rostelecom's revenue). Traffic goes to the network mobile operators, admits an employee of the press service of Rostelecom.

Until 2006, all operators were required to send long-distance and international calls through the Rostelecom network, but then other operators began to receive licenses for the right to provide these services on their own. Now there are about 20 of them, including MTS, VimpelCom and Megafon.

At first, the expansion of the "big three" was held back by the absence of main canals. They had to be rented from Rostelecom, MTT, Transtelecom, and calls were expensive. But in 2008, VimpelCom acquired Golden Telecom with a powerful cable network, and MTS and MegaFon began to build their own networks. As a result, mobile intercity and calls abroad have significantly fallen in price.

2008: Revenue of 66 billion, net profit - 7 billion rub

- Revenue - 66.6 billion rubles. (2008, IFRS)

- Net profit - 7 billion rubles.

INDUSTRIAL TRENDS

In the global telecommunications market, including Russia, there is a decline in the role of traditional services and a rapid growth in the popularity of ecosystem and platform solutions. The rapid development of technologies and the spread of solutions in the areas of the Internet of things, artificial intelligence and the use of big data are playing a critical role in the transformation of the industry.

Consumer behavior is also changing: there is a rapid development of visual communication channels, an increase in the use of social networks and increasing the value of personalized solutions.

Since the growth of the IT services market is significantly outpacing the market for traditional services, companies are focusing on new solutions beyond “basic products” to increase customer loyalty and increase sales. An important aspect of market development is also becoming the need for investments for the implementation of large-scale infrastructure projects, which the industry will rely on when introducing innovative technologies.

The growth of the telecommunications market in Russia in 2018 amounted to 3.4%, which became the best result over the past five years. The market volume reached 1.7 trillion rubles . The telecommunications market in Russia is consolidated by four major players, Rostelecom holds leading positions in many segments.

The main driver of the market growth was the second year in a row growing revenue from mobile data transmission. The strong results of the industry in 2018 continue to be supported by last year's initiative of operators to abandon price competition and increase the offer of additional services. The broadband and pay TV markets also showed stable positive dynamics. Fixed-telephone services and some inter-operator services continued to decline, but the rate of decline slowed. More than two thirds of the market, as in previous years, forms the client segment of individuals.

The Russian telecommunications market is divided among several major players with a combined market share of about 80%: MTS, MegaFon, Rostelecom, VimpelCom and Tele2 Russia.

Structure of the Russian telecommunications market by client segments, 2018, % Source: TMT Consulting.

Revenues of the Russian telecommunications market, 2015–2023, billion rubles Source: TMT Consulting.

The penetration of broadband Internet access in the segment of individuals in 2018 approached 60%. The total subscriber base reached 34.9 million due to the connection of new housing stock and small towns. The growth of industry revenues from access to broadband access in 2018 amounted to 3.2%, the revenue of operators reached 192.3 billion rubles. An important factor market growth in 2018 was an increase in the average subscriber bill, which confirms the trend towards rationalization of competition and the willingness of the subscriber to pay more for a stable and high speed internet.

Structure of the broadband access market in the B2C segment by operator revenue, 2018, % Source: TMT Consulting.

Structure of the broadband access market in the B2B segment by operator revenue, 2018, % Source: TMT Consulting.

Market share of Rostelecom by operator revenue, broadband access, 2016-2018, %

| segment | 2016 | 2017 | 2018 |

| B2C | 38 | 40 | 41 |

| B2B | 35 | 35 | 37 |

Source: TMT Consulting.

Number of broadband subscribers, 2015–2023, million Source: TMT Consulting.

Growth in the number of Pay TV subscribers slowed down in 2018, but the segment showed positive dynamics, increasing by 2.6% to 43.9 million subscribers; the service penetration rate exceeded 77%. Revenue in the segment also increased by 10% to RUB 92.6 billion. The average bill per subscriber was 177 rubles without VAT, which is 10 rubles more than in 2017. The cable TV segment continues to lead the market in terms of revenue compared to IPTV and satellite TV, but its share is gradually declining.

Market structure by income of Pay TV operators, 2018, % Source: TMT Consulting.

Revenue structure by Pay TV technologies, 2018, % Source: TMT Consulting.

Market share of Rostelecom by operator revenue, pay TV, 2016-2018, %

Source: TMT Consulting.

Number of Pay TV subscribers, 2015–2023, million Source: TMT Consulting.

The mobile virtual operator (MVNO) market has been demonstrating strong growth over the past two years and remains one of the promising directions in the telecommunications market. According to a study by TMT Consulting, at the end of 2018, the number of subscribers of virtual mobile operators amounted to 7 million, which is 18% more than a year earlier. Rostelecom leads the MVNO market in the B2B segment with a market share of 56% Source: TMT Consulting data, 2019..

The MVNO market is being developed by companies from related industries. In 2018, PJSC Sberbank launched its own brand of virtual mobile operator Sbermobile. Sberbank became the second bank after Tinkoff Bank to introduce a virtual telecom operator to the market in 2017.

Number of MVNO subscribers in the B2B segment, 2016–2018, million Source: TMT Consulting.

MVNO market structure by number of subscribers, 2018, % Source: TMT Consulting.

Number of fixed-line subscribers, 2015–2023, million Source: TMT Consulting.In 2018, the fixed telephony market continued to decline. Service penetration fell by 3 p.p. to 34.5%, while the number of subscribers decreased by 1.9 million to 26.3 million Source: TMT Consulting data, 2019.. PJSC Rostelecom remains the leader in the fixed-line communications market in all segments.

Structure of the fixed telephony market by operators, 2018, % Source: TMT Consulting.

The market continues to show consistently high growth rates. An important role in its development is played by the growth in the supply of exclusive content by online cinemas, the increase in user loyalty to legal OTT VoD services, and the entry of such major Internet companies as Yandex and Rambler into the market.

According to TMT Consulting, the online cinema market grew by 48% in 2018 and reached RUB 11.2 billion. The highest growth rates were received from paid model, – the share of revenue on it increased to 69%. At the end of the year, the market volume increased by 75% and amounted to 7.85 billion rubles. Advertising revenue brought 3.52 billion rubles, an increase of 10% over the year.

According to forecasts, by 2023 the size of the OTT video services market will be about 36.0 billion rubles, 86% of revenue will fall on income from paid services. The average market growth rate (GAGR) in the next 5 years will be 26%.

Forecast of OTT market development by revenue structure, 2014-2023, Source: TMT Consulting data, 2019. billion rubles Source: TMT Consulting.In 2018 Russian market the Internet of things (IoT) reached a volume of about 251.6 billion rubles Source: IDC data Russia.. The segment is one of the fastest growing in the market with an estimated growth rate of around 18% per annum until 2022. In Russia, the development in the field of the industrial Internet is mainly based on the integration of IT with the main activities of companies, the optimization of business processes and government initiatives to digitalize the economy.

Manufacturing and transport are the leading industries in terms of investments in the industrial Internet. The main areas of application of the technology at the moment are considered to be quality control of products and optimization of energy consumption.

The main trends in the development of the data center market include increasing the capacity of existing data centers and commissioning new data centers. In addition, development is expected cloud services. Rostelecom ranks first in Russia with 5.9 thousand racks in commercial data centers located in 13 cities.

The Russian market is influenced by the growing need of citizens and companies for data storage and processing, as well as work within state program"Digital Economy". In addition, the service model is gaining popularity, which implies the transition to outsourcing of its own IT infrastructure.

The average annual growth of the market for commercial data center racks is expected to be at least 9-10% in the next three years Source: iKS-Consulting data, 2019.. Thus, it is expected that by 2021 about 56,000 data center racks will be in operation in Russia.

Forecast for the development of data processing and storage centers in Russia, 2016–2022 Source: TMT Consulting data, 2019.Shares of market leaders of commercial storage and data processing centers by number of racks, 2018, Source: TMT Consulting data, 2018. %

Strong market growth information security will continue as the volume of data stored in information systems increases, as well as the growth of data transfer in projects " Smart House», automatic systems process control and the internet of things. In the period 2018-2022, the forecast CAGR for the market will be about 9%

Mar 03, 09:03

Aeroflot, Apple, US indices: what quotes to follow today What will determine the situation on the stock exchanges on Tuesday, March 3, and what assets should an investor pay attention to - read in the morning review of RBC QuoteJan 10, 03:46 PM

2020 in the game: how the gaming and esports industry will change Business giants are investing more and more money in computer sports and games. Earnings of companies in this sector are growing multiple every year. What will be the games of the future and how much can you earn on them?12 Nov 2019, 17:52

Mobile communications predicted price increases. What does this mean for operator shares Tariffs for cellular communication rise by 10-25% in 2020, media reported. Due to this, the income of cellular operators can grow. The editors of RBC Quote asked analysts how the quotes of Rostelecom, MTS and Veon would react08 Nov 2019, 06:14

RTKM Buy ₽100 (+26.28%) Forecast 17 Oct 2020 Go to date Promsvyazbank Analyst 74% Reliability of forecasts Rostelecom increased net profit and revenue. The company increased the number of its subscribers and sold 116,000 surveillance cameras04 Sep 2019, 15:06

02 Sep 2019, 15:31

Television for money: when Russians will start disconnecting from cable TV By 2023, 3 million Russians will give up pay TV. In the studio of the RBC TV channel, experts discussed how much subscribers are willing to pay for films and series and how to keep the viewer at the screen in 201902 Aug 2019, 15:01

RTKM Buy ₽82 (-0.36%) Forecast 02 Aug 2020 Go to date Aton Analyst 57% Reliability of forecasts The telephone operator Rostelecom improved its results in the second quarter and raised its forecasts for 2019. The company increased its performance due to the digital segment - VPN services and intercom connection. Shares fell08 Jul 2019, 18:54

RTKM Buy ₽87 (+9.16%) Forecast 01 Nov 2019 Go to date UBS Analyst 57% Reliability of forecasts Possible interim dividends and the issue of new shares raised the price of Rostelecom's shares. Over the past three months, quotes have added 8%. Analysts expect Rostelecom shares to continue to grow04 Jul 2019, 10:19

RTKMP Buy ₽80 (+27.08%) Forecast May 15, 2020 Go to date VTB Capital Analyst 52% Reliability of forecasts Rostelecom proposed to create a sky surveillance system throughout Russia. Such a system will cost taxpayers ₽400 billion. Analysts assessed whether it is worth buying Rostelecom shares in anticipation of a major contractJun 18, 2019, 06:53 PM

RTKMP Buy ₽82 (+29.24%) Forecast May 14, 2020 Go to date Aton Analyst 57%