How to calculate time spent per client. How to Calculate Customer Acquisition Cost (CAC) - Instructions

At the start, many entrepreneurs are ready to do anything to attract new customers. But not everyone understands what marketing moves need to be done in order not to throw money away and get the maximum benefit from advertising. Every business owner needs to know the cost of customer acquisition or CAC. If you learn how to calculate it correctly, then you can achieve the maximum, as well as predict the marketing budget for the future. Understanding the meaning of this indicator will help you find the best channels to attract new customers at the lowest possible cost.

All successful brands carefully calculate CAC, analyze and use this information for optimization.

What is Customer Acquisition Cost (CAC)?

CAC - an indicator that determines how much one costs new client. Sometimes the term User Acquisition Cost is used - the cost of a new user.

What does SAS depend on?

- From advertising and sales costs. This includes the salary of all marketing and sales employees, non-production costs for their maintenance, the cost of marketing tools;

- From attracted new customers.

When running any business, you need to know how much profit you can get from investing in advertising. When investing in advertising to promote a business (website development, radio, TV, social media, banner ads), everyone wants to know what and when they will get in return.

If you calculate the return on a new paying customer in the future (in relation to the customer's life cycle), you can see whether the money invested pays off and which advertising moves are most effective in obtaining new customers.

Many people confuse CAC with the term CPA (cost per action). CPA is a payment on the Internet for a certain action (for example, registration fee, download fee, purchase fee). The company pays everyone, both new and existing customers. It is essentially absolutely different terms, which have nothing to do with each other, since CAC refers to all the costs associated with sales and marketing.

In a more understandable language, CAC is the amount of money spent on advertising to attract new customers. This is the main factor that shows how the company has successful model business.

A careful and correct calculation of CAC shows which customer acquisition channels work most effectively and which marketing moves are best to invest your money in.

Understanding CAC is very important for any company, as it is a reflection of the success of the business in the future. At first, you need to invest a lot of money and finances to attract customers, but with each subsequent month, the costs will decrease, and profits will grow if you correctly analyze the CAC calculation formula.

There are four reasons why CAC is needed:

- The calculation of CAC is necessary to understand how long it takes to make a profit after an advertising campaign and how much money will be spent on attracting a client.

- The CAC indicator helps to calculate and increase the LTV / CAC ratio.

- It is necessary to review the effectiveness of marketing campaigns every month and analyze their effectiveness.

- The goal of any business is not only to generate income, but also to increase margins. CAC will show the ratio of gross profit to the cost of attracting new customers.

How to calculate the cost of customer acquisition?

There is a simple formula for calculating SAS. It is necessary to divide the amount of absolutely all funds spent on attracting customers for certain period time by the number of clients attracted during this time.

But you need to understand that this formula has exceptions, and the final CAC figure will not quite correspond to reality. In what cases and why does a simple formula not work effectively?

- If the company has made investments in advertising in a new region.

- According to statistics, it takes 60 days for a potential buyer to become your new client.

- Many buyers are considered return buyers rather than new ones.

- Additionally, there are costs associated with user support. Many people use the demo version of the product for free for a very long time before they make their first purchase.

You can use a simple formula when all used complement and enhance each other's effectiveness.

Before you start calculating SAS, you need to answer the following important questions:

- How long does it take between an advertising campaign and the appearance of new customers?

- What costs should be included in the CAC calculation formula?

To understand how long it takes to return the invested funds, it is necessary to calculate the payback period of the client. You need to divide the income from one client per month by the cost of attracting him.

To understand which CAC figure will be optimal for your business, you need to focus on the ratio of two metrics: LTV and CAC.

LTV is the profit from an attracted client for the entire time that he stays with you (Customer Lifetime Value), and CAC is the cost of attracting him.

There is a scale that allows you to identify the optimal ratio of LTV and CAC:

Cost of customer acquisition and its importance for business

To get closer to the ratio of 3:1, you need to look for new channels to attract customers.

The full formula for calculating SAS is as follows:

MCC - the total amount of funds spent on advertising;

W - salary of marketing - specialists;

S - costs for software and online services;

PS - the cost of professional services;

O - overhead costs;

CA - the number of clients attracted by the spent amount of funds.

To get a reliable result, you need to calculate CAC for each used advertising direction separately. Then you will understand which marketing move is most effective and in which direction it is necessary to increase investments.

Much more customers can be acquired if more money is invested in channels with a low cost of acquisition. At the same time, the total amount of funds for marketing will not increase.

We calculate SAS on examples

Your customers don't care about your costs, they want to know how your service can solve their problems. Therefore, the company's pricing strategy should not be built on marketing costs, but it is necessary to calculate the CAC. Let's look at examples of calculating the cost of a customer at various companies.

SaaS company

For example, a SaaS company provides domestic sales. Someone buys right away, and someone will turn from a potential buyer (lead) into a real buyer only after 60 days.

For example, a company tried a few new channels in June, spending $5,000 on marketing. This month, 50 new clients were attracted. So CAC is $100. But it must be taken into account that due to advertising company in the month of June, after 60 days, the likelihood of more buyers will increase significantly.

Therefore, it is worth analyzing the effectiveness of the June advertising campaign in two months. In August, for example, the number of buyers rose to 100 people. So the CAC is $50. Therefore, when calculating, do not forget about the time interval between marketing costs and.

Then the equation for calculating CAC will be like this:

CAC = (Marketing Costs (n-60) + 1/2 Selling Costs (n-30) + 1⁄2 Selling Costs (n)) / New Customers (n)

n = current month

eCommerce company

For example, a natural sweets company invested $200,000 in advertising and attracted 20,000 new customers. So CAC is $10.

The average check of the buyer is $25, and the markup on the goods is 100%. Then the net profit is $12.5, of which $2.5 goes to salaries, offices, etc.

You need to understand that some customers will switch completely to this brand, many will become regular customers, that is, you need to take into account the metric life cycle customer (CLV, customer lifetime value). We will talk about how to calculate CLV below.

If most customers buy sweets once a week for $25 for 20 years, then CAC of $10 with an average check of $25 is a pretty good result for such a company.

Online casino

They make a profit in case of losing players. Accordingly, the more of them, the higher the profit.

For example, a company spent $1,000,000 on marketing campaign poker room.

Each player will play about 60 combinations per hour. If 20 players play in the casino at the same time, then the casino will receive a profit of at least $1000. If the number of participants is 100 people, then the profit from one will be about $ 50, and from 100 people - 5000. This is only in the first months, then the percentage of profit will increase due to the return of players and the addition of new customers.

Calculation of LTV (customer lifecycle metrics)

LTV = (average cost per sale) x (average number of sales per month) x (average customer retention time in months)

For example, a person pays a subscription to yoga classes $ 20 per month for 2 years, then $ 20 x 12 months x 2 years = $ 480, but not all clients will go to yoga for 2 years. Therefore, there is a more accurate calculation formula for life value clients.

LTV = (average number of orders per month) x ( average check) x (average duration of customer interaction with the company) x (share of profit in revenue).

Common mistakes in calculating CAC

- Many people forget to add to the CAC calculation wages marketers and salespeople or those professionals who assist in marketing campaigns.

- The calculation must include the cost of renting equipment for these employees.

- Do not forget to include the cost of marketing tools in the calculation of CAC.

- It is necessary to conduct analytics on the site, how many orders came from a particular blog. End-to-end analytics is also needed - the connection between the visitor's source and his first purchase.

- The calculation does not need to take into account the number of old customers.

How to reduce CAC?

There are several methods to optimize SAS:

Well-Known Indicators management accounting far from always give an understanding of the real state of affairs in business in full. For example, contribution margin generates an increase in operating profit when each individual sale contributes to cost coverage. Everything seems to be simple. However, in many areas modern business, in our hyper-competitive society, margins can be very, very high, but the cost of acquiring new customers can also be very high..

Traditional cost management does not work here, because today we spend money on attracting tomorrow's customers and cannot be directly matched. In addition to this, success in such a business can only be achieved by achieving high level customer loyalty, which current expenses on customer acquisition (and on future sales) will tend to zero and profits will remain high.

What is CAC and CLV?

The software industry, more specifically "SaaS" (Software as a Service, cloud services), has popularized two concepts that we think can be applied to many industries to help better and more comprehensively assess the state of the business:

CAC(Customer Acquisition Cost) or " customer acquisition cost" - shows the average cost required to acquire a new customer in a particular channel or product.

CLV(Customer Lifetime Value) or " lifetime value client"- shows total amount Money, received from the client, from the moment of "acquisition" of the client (for example, from the moment of its first purchase).

In a SaaS business, customers pay monthly or yearly fees to access cloud software. This is comparable to a subscription service fee: a standard situation in which customers pay every month or year until they decide to stop. This pattern is similar to repeat business, where customers purchase a product or service periodically (for example, consumer goods or consulting services). We think that these figures can be calculated for most types of businesses, it's just that in some cases it is not so easy to get the necessary data for this.

How to measure CAC and CLV?

There are several ways to do this. We will show how to calculate these parameters using the example of the Odoo direct sales team in Europe. They sell subscriptions online, as opposed to an indirect sales team that organizes sales through a network of partners. Odoo uses an inbound telesales model where customers contact us through the website and employees complete the transaction over the phone.

For non-subscription businesses, the CLV is based on purchase frequency and average check size. If buyers stop buying after a certain period, then we can talk about an outflow. For companies that are mainly engaged in indirect sales (so-called consumer goods), CAC and CLV parameters can be measured through sales statistics or consumer demand studies. I think these metrics are also important in assessing the viability of their products or destinations, and identify actions to improve them (decrease churn, increase repeat purchases, etc.). But I don't think they are really measured in most companies in these industries.

How to interpret CAC and CLV values?

CAC and CLV and their ratio (CLV/CAC) are extremely helpful in understanding how to balance your business and determine the next steps:

If CAC > CLV or CLV/CAC ratio<1, то ваш бизнес в упадке или нежизнеспособен. У вас слишком большой отток или чересчур высокий уровень CAC. Также причиной этому может быть то, что у вас слишком низкий показатель среднего чека. Вам нужно будет приложить серьезные усилия для улучшения работы или перейти к другой бизнес-модели.

If CAC< CLV или их отношение CLV/CAC >1, then you're fine. However, if the ratio is close to one, then your business is on the margin of profitability. Also, if you have a good churn rate (less than 10%), then you are likely to rely heavily on customer revenue in the second year. This means that your cash flow will run a deficit all the time, since CAC must be paid immediately (and usually in advance).

What else is useful to know?

If you're forecasting revenue from customers after they've been acquired, it's fairly easy to calculate the cumulative profit and check when it "crosses the line": when the cumulative cash flow from the customer exceeds the cost of acquiring the customer. Here are some examples:

- Clients pay annually and their self-sufficiency occurs in less than a year. Great, your growth can be funded by your own clients. This option is very rare, but still possible. Typically, this alignment is typical for companies that are perceived as market leaders in a period of significant market destabilization.

- Customers pay monthly (or repurchase every month or more) and are self-sustaining in less than a year. Great, but be prepared to fund new client acquisition up front.

- Self-sufficiency occurs later than in a year (but earlier than two years). In many cases (other than when you have multi-year prepaid contracts), you will need significant funding to grow your business. Although, if everything is in order with the level of outflow, then the business will stay afloat. Many Saas startups fall into this category.

- If the payback period exceeds two years, then the business is most likely not viable. Except when you are in the long term. This is often the case, for example, in the real estate industry. But this is unacceptable in low capital or high risk businesses such as start-ups. Especially in times of market volatility, when churn should be kept very low.

In marketing, there is such an indicator - Customer Acquisition Cost, the cost of attracting a client. Why is it needed, how to count it and what happens if this is not done - we understand the article.

Imagine that we need to sell pink elephants.

We call all our friends and classmates, rent a presentation room, everyone gathers, we talk about the benefits of elephants and as a result we sell 20 elephants. The sale of each elephant brings us $100. The rent for the hall was $200.

Would it be correct to say that our profit was 2000-200=1800 dollars, and attracting one client cost 10 dollars?

And the second, much more important question, can we base our calculations on further sales on the basis of this first experience?

Of course, the answer to both questions is "No".

I'm sure you easily answered the same way and can explain why.

If not, let's think together.

Understanding the terms

Calculating CAC is simple: all marketing expenses and all sales expenses for a certain period of time must be divided by the number of attracted customers. The only problem is to count all costs.

Let's not complicate things and define LTV as the amount of money that we plan to receive from one client for the entire period of his activity.

When talking about CAC, the LTV indicator is important - without knowing how much money a client will bring us, we cannot determine how much we are willing to spend on attracting him in order to make a profit.

CAC and LTV indicators are needed to calculate an indicator of the "quality" of the client that is acceptable to us. It is calculated by the LTV / CAC ratio and it is generally accepted that if this indicator is more than three, everything is fine. Simply put, if a dollar invested in attracting a client brings three dollars, that's great. Who would argue.

Politically correct clarification: the concept of “quality” of a client is not related to the personal, business and any other qualities of a particular client or segment of clients. It's not even about money as such. It's about cost-benefit ratio. A client that cost us a dollar and brought us five is better than the one that brought us a million and cost us 990,000.

Intermediate result: understood the terms and concepts

CAC - customer acquisition cost. How much did we spend for a client to buy from us.

LTV - how much money this client will bring us.

LTV/CAC is a ratio showing the quality of the client. If the ratio is greater than 3, this is a quality client.

Back to the elephant story

If we only spent money on renting the hall and sold 20 elephants, we can say that the CAC was $10.

We can say. And, at first glance, it will look like the truth. But only for the first.

For example, we forgot to take into account that we involved our employee to create the presentation. Who spent a full day on its creation. We paid for this day (the employee receives a salary, right?)

We also did not take into account that it took us two days to call all our friends and classmates, these days we did nothing else, only called. In addition, some call recipients were in roaming and the mobile operator withdrew additional money from our balance.

We took one elephant for a presentation as an exhibition copy - we spent money on a truck and a watchman.

The first conclusion: when calculating the CAC, all costs must be taken into account.

But this is not the main problem - after all, it is not so difficult to identify all the costs and calculate them more or less correctly.

The problems start when we move to scaling - we need to sell a lot of elephants every month, don't we?

And then it turns out that all our previous calculations of the SAS do not make much sense at all and cannot be used to build a business model for further development.

Because we sold these twenty elephants to friends, girlfriends and other classmates. And half of these elephants were bought simply because we were selling them, it was inconvenient to offend us, and receipts for paying for unnecessary elephants will fly into the nearest trash can immediately after leaving the presentation.

That is, in order to calculate the size of the SAS at least somewhat correctly based on this whole story, you need to add some more components to these calculations.

Which is almost impossible to express in numbers.

Since, in fact, we are talking about sales to a loyal audience, but this loyalty is of a special kind and its cost cannot be calculated. Yes, and we do not need to count anything here. Because friends and classmates are not the target audience of our product at all.

We sat next to one of the buyers on the potty in kindergarten, we knocked out his tooth in the fifth grade, in the ninth grade he took our girlfriend away from us, at the graduation we brushed aside the crowd of gopniks for a couple, he could not come to our wedding and apologizes for this for many years already - in what numbers can you calculate Customer, his mother, Acquisition Cost ?!

The second conclusion: when calculating the SAS, not all costs can be identified and correctly calculated.

If it seems to someone that we have now climbed into abstractions that have little to do with reality, it seems to you in vain. If you look around, you will surely find examples of how businesses did not take off or took off crookedly or flew "low" and not for long precisely because of a poorly calculated or not calculated CAC at all.

LTV more than CAC is good. And when it's the other way around, it's bad. Image from blog.profitwell.com

Three main mistakes that the correct calculation of CAC can save you from

1. We already described the first one in the story about elephants - many people mistake non-scalable factors for scalable ones. If four people came to your new site and made two purchases, do not rush to build your further business plans from a 50% conversion. It is possible that the wife, father, mother and brother came in, the wife and mother bought it. Mom out of love, wife out of courtesy, dad also wanted to, but was distracted, brother in the fifth grade and could not buy anything with all his desire.

2. You will spend too little.

Let's get back to the elephants. We realized that we had made a mistake in our CAC calculations, got nervous and began to hastily “cut the bones”. They abandoned all plans for advertising and promotion, fired sellers, wrote an ad "elephants for sale!" and hung it on a pole.

This gives three sales per month with almost zero CAC. Profit 300 dollars. There is no point in keeping such a business afloat, we are closing.

3. You will spend too much.

After the presentation and the first sales, we realized that we wanted to sell elephants again and again. They rented the hall again, hung the city with advertising posters, connected television and the Internet. Five times more people gathered in the hall than the first time. And we sold them 20 more elephants.

Everything would be fine, but this time, in addition to the cost of renting the hall, there were also advertising costs. How about "more"? These were the main costs - $ 3,000. Plus rent. There was a $1200 loss. CAC turned out to be higher than LTV, speaking in terms that we met today.

The problem that will always face you as long as your business is alive

Correct calculation and reduction of CAC. You will always have to deal with this problem. You are like a tightrope walker who has to go through and not fall into a too low CAC that cuts off the majority potential clients. Not too high, capable of "gobble up" all the profits.

How to lower CAC

1. Optimize your sales funnel.

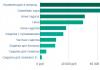

Look at each step of your funnel, find weaknesses, advertising channels that give the least number of conversions, check the possibility of redistributing expenses on these channels in favor of more conversion ones.

2. Optimize prices.

It's not just about raising prices, although sometimes that's the most beneficial thing to do. But it is worth paying attention to the structure of payments: advance payments, prepayment, regular payments. If this helps to increase LTV, the “quality” of the client will increase automatically. Formally, CAC will not decrease, but will become more acceptable.

3. Develop content marketing.

Content marketing is one of the cheapest and most profitable long-term options for customer acquisition. Introduce potential customers to your product, involve them in its use and discussion. CAC loyal customers much lower, this must be used.

Tinkoff Bank spent 3 billion rubles on attracting customers in the first half of the year, according to its IFRS financial statements. This is the second largest item of non-interest expenses of the bank after administrative expenses of 5.1 billion rubles.

The bank includes expenses on advertising and marketing (1.6 billion rubles), personnel directly related to work with new clients (1.2 billion rubles), services of credit reference bureaus (121 million rubles), telecommunications (66 million rubles).

These costs include attraction to all business lines - loans, transactional products, Tinkoff Black (debit card), insurance, mortgage broker, SME services, etc., the bank representative said. He declined to disclose what share each of the segments and what the total number of attracted customers.

According to the bank, it attracted 460,000 new active clients in six months. The representative of the bank assured that this concept includes only customers who have activated their credit cards. For the same period last year, the bank attracted 175,000 new active customers, follows from the bank's materials, and it spent 1.5 billion rubles on attracting all segments. The year-on-year increase in costs is associated with an increase in marketing and advertising expenses (mainly due to TV advertising), as well as with an increase in personnel costs - the bank hired new people in connection with business expansion, and also indexed salaries, a representative of Tinkoff explains jar".

Other banks in their reporting do not separately disclose the cost of attracting customers: Russian Standard, OTP Bank, HKF-Bank, VTB 24 did not provide figures. “The cost of attracting a new client applying for a loan of up to 300,000 rubles is on average 800-2500 rubles,” says Yury Kudryakov, general director of the Unicom 24 financial market. The cost of concluding one loan agreement with Post Bank is 3,500 rubles, its marketing director Evgenia Lenskaya told Vedomosti earlier.

Tinkoff Bank traditionally allocates customer acquisition costs in its reporting - these are the costs of new customers, Fitch analyst Dmitry Vasiliev points out. In his opinion, taking into account the bank's return on equity for the first half of the year at about 40%, these expenses are not very significant.

“We receive about 500,000–600,000 credit card applications a month,” says Tinkoff Bank CEO Oliver Hughes. “If we want to do more, we will do more.” According to him, the bank finds borrowers through the Internet, partners (for example, Svyaznoy or Euroset), mobile channels, loyalty programs, advertising, etc. Hughes points out that Tinkoff Bank selects only high-quality borrowers who have relatively small debt load or no loans at all. “We have very small starting limits on cards - about 35,000 rubles, which is approximately equal to the monthly salary of our incoming flow,” he concludes. Behind Lately loan approval rate increased from 15% to 25%.

All these measures helped Tinkoff Bank to increase its loan portfolio by 10% over six months to RUB 111.4 billion. (before provisions), growth was due to the segment credit cards– the card portfolio of the bank is 101 billion rubles.

In 2014–2015 Tinkoff Bank reduced risk appetite, which led to a gradual improvement in asset quality and, as a result, financial results Vasiliev says. However, despite the work done, the bank will be negatively affected by the unfavorable economic situation: the real incomes of the population have been falling for 20 consecutive months, so the bank, even if most its portfolio is made up of loans issued under new, more stringent standards, is not immune from deterioration in asset quality in the future, he points out. According to him, the losses of "Tinkoff Bank" (the percentage of loans that go into delinquency for a certain period of time on an annualized basis) are at the level of other players. So, for six months this figure was 12%, for the II quarter - 11%, says Vasiliev. The share of loans overdue for more than 90 days decreased from 11.3% in the first quarter to 10.9%, VTB Capital analysts calculated. The deposit base of Tinkoff Bank is also growing - in six months, customer funds increased by 13% to 101 billion rubles, according to reports. At the same time, for the second quarter in a row, Tinkoff Bank receives a record profit: in the II quarter it earned 2.5 billion rubles, and in just the first half of the year - 4.4 billion rubles.

can afford

The management of Tinkoff Bank retained all the forecasts it gave earlier, except for the return on equity: it will exceed 30%, while earlier the bank expected it to be more than 25%. The bank plans to net profit at the end of the year at the level of 7-8 billion rubles, the cost of risk and the cost of funding - 10-12%, net portfolio growth - 15-20%.

To earn money, you must first spend it, and wisely and according to the exact calculation. We talk about the cost of attracting a client: why does a business need to know this indicator, how to correctly calculate, use and reduce it without losing efficiency.

What is customer acquisition cost

Customer Acquisition Cost is the money a company spends to acquire a profitable customer. This value is also abbreviated CAC, from the English customer acquisition cost.

Do not confuse CAC with a similar indicator - (CPL, that is, cost per lead). A lead is an application for a call, a left phone number or mail, that is, any stage on the way to a deal. A lead does not yet guarantee that a person will become a client and bring money.

What is the optimal cost per customer?

To understand whether you can afford the current cost of acquiring customers, you need to calculate their lifetime value, or LTV. This is the profit that, on average, the buyer brings to the company. We have collected methods for calculating LTV and convenient tools for automatic calculation in the article "".

A business is considered profitable when the lifetime value of a customer is at least three times higher than the cost of acquiring it. If the difference is smaller, it is worth reconsidering the strategy and reducing costs, because now you are working at zero or even in the red.

Why Calculate CAC

For example, let's calculate the cost of attracting a client using a simple basic formula: divide the costs of an advertising campaign by the number of clients received.

For example, you received 5 orders from Facebook advertising at a campaign cost of 3,000 rubles. So, one client cost you 600 rubles. And the paid line in the search results brought 7 orders at a cost of 7 thousand rubles. It turns out that the cost of attracting a client is a thousand rubles.

The basic formula does not take into account various additional costs, but the essence is clear: the calculation of CAC helps to understand which channel allows you to find buyers at minimal cost. And also to understand whether your business is profitable, as we wrote above.

Important! Calculate for individual channels not only the cost of acquisition, but also the lifetime value of the client. It is possible that more profitable buyers will come from individual channels, who will bring more profit even at a higher acquisition cost.

How to calculate customer value

As usual, there are two ways - easier and harder. We have already shown a simple one, it is suitable if you have a small company and need a basic approximate calculation. If the numbers are needed for further analytics and strategy, it is better to spend a little time and use the detailed CAC calculation formula.

Before the settlement, you need to determine who you will consider the buyer. For example, whether to take into account the customer who bought trial period your program for a symbolic 100 rubles? Or, for now, classify it as a lead, not a customer? There is no single answer, you must determine for yourself what action you will consider a purchase.

Important! If you have customers who don't pay for services, such as a free base rate, don't include them in your customer cost calculation.

Here is how a detailed calculation of the cost of attracting one customer looks like:

The following information is used in the calculation:

- MCC (marketing campaign costs) - total costs on advertising campaigns to attract customers;

- W (wages)- salaries of marketers and salespeople;

- S (software)- software (CRM, website development and support, analytics services, and so on);

- PS (professional services)- payment for all additional services if they were made by external specialists (design, analytics, video and photo, and so on);

- O (other overheads)- other overhead costs.

Consider time. In some industries, buyers make decisions up to several months: it can take a long time to choose a machine or expensive software for a company. In this case, the cost of attracting will begin to pay off only after a few months, and this must be understood when calculating. At the same time, seasonality must also be taken into account, so ideally it is better to calculate for the whole year.

How to reduce customer acquisition cost

You can and should save on attracting customers. Even if the business is profitable, look for possible ways to reduce costs. Here's how you can lower CAC without losing effectiveness.

Look for new promotion channels

- Salary and additional services. With SendPulse, you don't need a designer, email layout designer, or analyst. There are already ready-made templates that can be easily tweaked in the visual block editor. Templates do not fit - create your own, it's very simple. The service also provides statistics on mailings, can be integrated with Yandex and Google analytics, and makes it possible to conduct A / B testing before sending.

- Software. Work for free plan, store a database of up to 2.5 thousand addresses and send up to 15 thousand letters per month - this is enough for a small business.

Once you've calculated your acquisition channel metrics, don't narrow down your strategy to the one or two most profitable ones. Remember that parallel advance enhances the effect, for example,.

Analyze buying behavior

Use tricks - build chains through which people will reach the purchase. Analyze weaknesses: maybe customers leave because of an inconvenient site or a complicated purchase process, or they lack information about the product. Buying behavior analysis will help not only optimize the purchase chain, but also identify in advance the most profitable customers with a potentially high LTV.

What is worth remembering

Customer Acquisition Cost (CAC) is the amount of money spent on acquiring one customer, which ultimately brings profit to the company. Do not confuse CAC and CPL (cost per lead). A lead is only a stage on the way to a deal, it is not a guarantee of profit.

CAC is calculated to determine the most profitable acquisition channels - those that bring customers at the lowest cost.

CAC must not exceed a third of the client's lifetime value. That is, all the profit that the client brings to the company during the cooperation. If it is above a third of LTV, then the company is most likely operating at zero or at a loss.

To calculate CAC, you need to sum up all marketing costs and divide by the number of customers. As customers, only those buyers who bring money to the company are taken into account - they bought the product, and did not subscribe to the free version.

What is included in marketing costs:

- money spent on all advertising campaigns;

- salaries for marketers and salespeople;

- software (website, all used services);

- payment for the services of freelance specialists, if they are involved;

- all other expenses related to marketing.

The cost of customer acquisition can be reduced without losing efficiency. For this you need:

- look for new promotion channels, use them comprehensively;

- analyze customer behavior and rebuild the sales funnel.

Constantly analyze your work, this is important even for a small company. Register at free services, for example, SendPulse, so as not to spend money on a marketer's email. You can always try to optimize business processes and put every penny saved on business development.